As we look toward the future of industry and innovation in southwest Wales, the Celtic Freeport is emerging as a beacon for inward investment.

What sets the freeport apart is not just its economic incentives but its strategic positioning and robust infrastructure, designed to attract and sustain large-scale, global enterprises in the renewable energy sector, particularly floating offshore wind (FLOW).

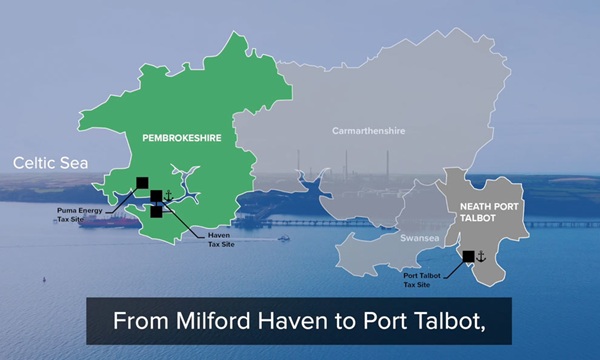

First and foremost, the Celtic Freeport's physical geography offers an unmatched logistical advantage. Located near the developing offshore wind farms in the Celtic Sea, the Freeport minimises transportation costs for moving massive structures essential for FLOW projects. This geographical closeness is a critical factor in reducing operational expenses and enhancing the efficiency of deploying large-scale wind installations.

Another significant draw is the access to a skilled workforce. Southwest Wales is home to a pool of talent with expertise in engineering, manufacturing, and maritime operations. This ready availability of skilled professionals not only facilitates the immediate needs of incoming businesses but also ensures a steady pipeline of local talent, trained and ready to meet the evolving demands of the renewable energy sector.

From a financial perspective, the Celtic Freeport will also offer a suite of incentives that make it an exceptionally attractive investment destination. These incentives are tailored to reduce the initial fiscal burdens and operational costs for businesses setting up within the Freeport:

- Land Transaction Tax Relief: This incentive is critical for businesses looking to establish a long-term presence by acquiring leases or freehold properties. It significantly reduces upfront costs.

- Accelerated Capital Allowances: Businesses benefit from enhanced capital allowances on plant, machinery, and building structures. This not only aids in setting up substantial manufacturing facilities but also encourages continual reinvestment in technological advancements and capacity expansion.

- Employer National Insurance Contributions Relief: A crucial incentive that reduces the cost of employing new staff, making it financially viable for businesses to expand their workforce rapidly as they scale operations.

- Business Rates Relief: Perhaps one of the most compelling incentives is the significant relief from business rates for up to five years. Given the scale and type of facilities being developed, this could equate to savings of millions of pounds, vastly improving the financial outlook for new businesses.

These strategic advantages and financial incentives align to position the Celtic Freeport not just as a national asset but as a competitive player on the global stage. By mirroring the incentives that global companies seek worldwide, the Freeport ensures that the local economy of Southwest Wales can compete effectively in the high-stakes arena of international business and renewable energy development.