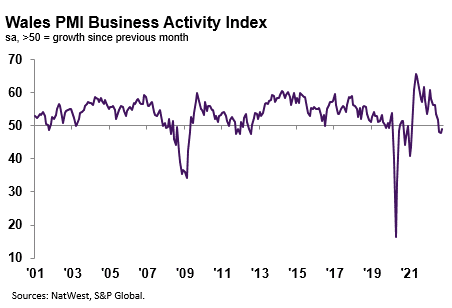

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 49.1 at the start of the fourth quarter, up from 47.7 in September.

The rate of decline was marginal overall, with firms linking the decrease to weak client demand and economic uncertainty. The pace of contraction eased from September, with firms attributing this to the arrival of delayed inputs and the processing of backlogs of work. Welsh firms recorded a slower fall in output than the UK as a whole.

Welsh private sector firms registered a third successive monthly decline in new orders during October. The rate of contraction quickened to a strong pace that was the fastest since January 2021. The decrease in new business was sharper than the UK average. Anecdotal evidence suggested the fall in new orders was due to economic uncertainty and hesitancy or postponements among clients.

October data signalled a decrease in the level of optimism among Welsh private sector firms. Although still confident of a rise in output over the coming year, the degree of positive sentiment dropped notably from September and was the lowest since data collection for the series began in July 2012. Firms stated that optimism stemmed from new product launches and hopes of price stability. That said, concerns regarding wider economic conditions in the UK and globally, alongside moves away from non-essential spending among customers, weighed on confidence.

Workforce numbers across the Welsh private sector continued to increase in October. Although some firms noted that greater employment was linked to expansion in capacity, the rate of job creation slowed to the softest since May 2021. Hiring activity eased due to weak client demand, according to some survey panellists. The trend in Wales reflected that seen across the UK as a whole which also saw a modest, but slower, increase in staffing numbers.

Welsh private sector firms recorded a further decrease in the level of outstanding business at the start of the fourth quarter. The rate of contraction quickened to a strong pace that was the steepest since July 2020. Panellists mentioned that lower new orders allowed them to work through any backlogs of work. With the exception of Northern Ireland, Welsh companies registered the sharpest fall in incomplete business of the 12 monitored UK areas.

Operating expenses faced by Welsh private sector firms increased at a marked pace in October, but the rate of inflation lost momentum. Higher cost burdens were often attributed to greater utility, material, wage and fuel prices. Some companies mentioned that currency weakness had exacerbated price hikes for imported goods.

Welsh firms registered the third-fastest rise in input costs of the 12 monitored UK areas, with only Northern Ireland and the East Midlands registering quicker increases.

Average selling prices at Welsh private sector firms rose at a substantial and faster pace at the start of the fourth quarter. Many firms stated that hikes in output charges were due to greater cost burdens and the need to pass-through higher prices to customers. Although one of the slowest in just over a year, the rate of charge inflation was the fastest across all 12 monitored UK areas.

Kevin Morgan, NatWest Wales Regional Board, commented:

“Welsh firms indicated a further challenging month in October, with demand conditions weakening and confidence slumping going into the final stages of 2022. Hesitancy and postponements among customers weighed heavily across the private sector, with output contracting at a slower pace due to the clearance of backlogs of work rather than any pick-up in demand. Firms also scaled back the rate of job creation for the fourth month running, as employment rose at the slowest pace since May 2021.

“Meanwhile, pressure on margins and weak demand led firms to push up their selling prices despite a softer uptick in input costs. Inflationary pressures in Wales remain marked and well above the historic trend.”