A new report by UK merchant payment provider, Dojo, part of the Paymentsense brand, reveals which global and UK industries have been the most affected by the unprecedented economic and social impact of the COVID-19 pandemic.

Using Yahoo Finance and public Purchase Intent data, the report analysed and ranked which industries benefited from the ‘unforeseen changes’ in their customers’ lifestyles during the period March to November 2020 of the pandemic.

Some previously unknown companies have become household names; their industries becoming pivotal in post-corona life, whilst other industries have struggled to stay afloat. But as we enter yet another lockdown in 2021, which ones are the ones to watch?

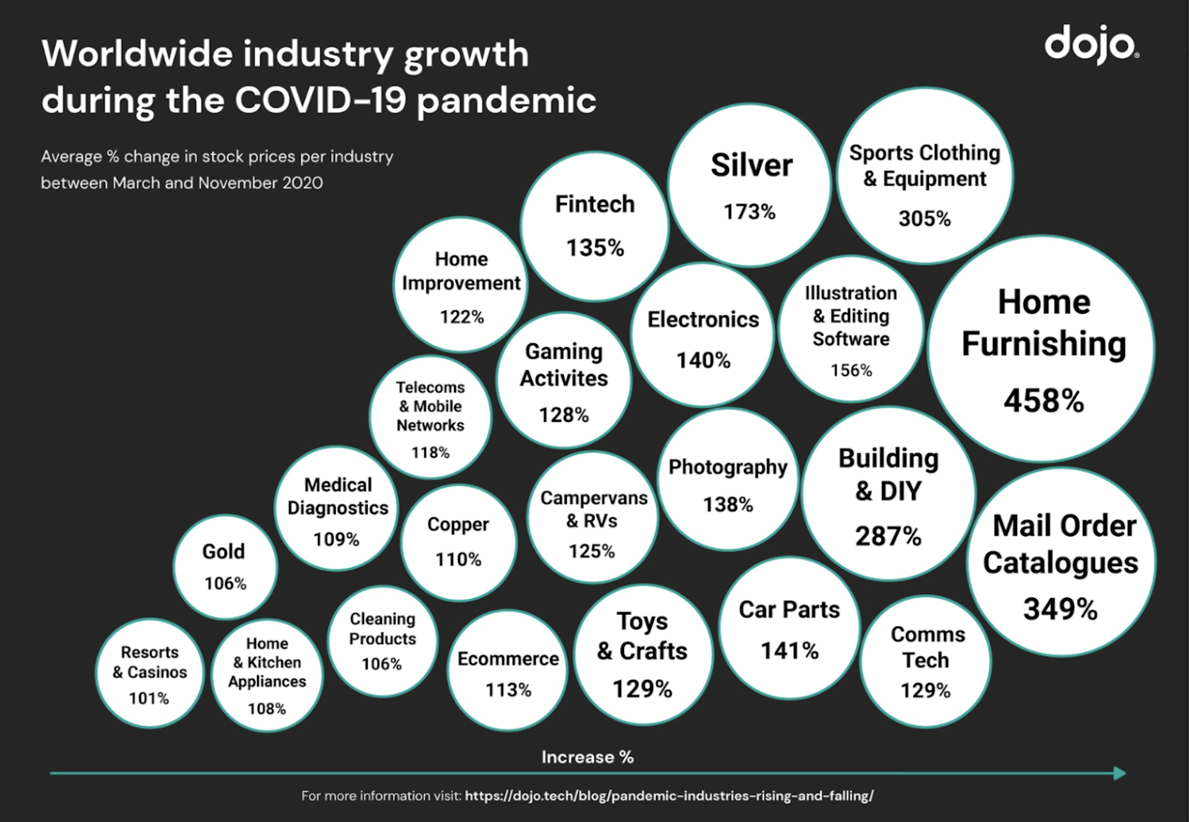

Home Furnishings sales have grown almost 500% worldwide since last March

The top industries that saw upwards of 100% growth since March

| Rank | Industry | Ave. % change from March to Nov |

| 1 | Home Furnishing | 458.3% |

| 2 | Mail Order Catalogues | 349.2% |

| 3 | Sports Clothing & Equipment | 305.8% |

| 4 | Building & DIY | 287% |

| 5 | Silver | 174% |

| 6 | Illustration & Editing Software | 156% |

| 7 | Car Parts | 141% |

| 8 | Electronics | 141% |

| 9 | Photography | 138% |

| 10 | Fintech | 135% |

| 11 | Toy & Crafts | 130% |

| 12 | Comms Tech | 129% |

| 13 | Gaming Activities | 129% |

| 14 | Campervans & RVs | 126% |

| 15 | Home Improvement | 123% |

| 16 | Telecoms & Mobile Networks | 118% |

| 17 | Ecommerce | 113% |

| 18 | Copper | 110% |

| 19 | Medical Diagnostics | 109% |

| 20 | Home & Kitchen Appliances | 109% |

| 21 | Cleaning Products | 107% |

| 22 | Gold | 107% |

| 23 | Resorts & Casinos | 101% |

Populations around the world have experienced varying levels of restrictions, including a spate of national lockdowns, forcing a global shift in consumer habits. With orders to stay home for months on end, it’s unsurprising that Home Furnishing sales soared as the public desperately sought to make their homes a sanctuary.

Home workouts also drove a 305% increase in the sale of sporting goods and clothing, due to the world's new-found love for online workouts, fuelled by the likes of PE with Joe.

New hobbies and gaming are still the go-to boredom breakers

Illustration & Editing Software (+156%), Photography (+138%) and Home Improvement (+122%) all saw huge growth, as people worldwide found other ways to fill their time, aside from creating TikToks. Gaming Activities, aka online gaming, also enjoyed a 129% boost in sales, making 2020 the year recreation was king.

The impact on industries in the UK: Supermarkets grew by 6%

Ranked: UK Purchase Intent sees surge in online shopping & soft drinks industries

| Rank | Industry | Ave. % change from March to Nov |

| 1 | Supermarkets | 6.0% |

| 2 | Online Shopping | 4.9% |

| 3 | Mixed Goods Retailers | 4.9% |

| 4 | Soft Drinks | 3.3% |

| 5 | General Insurance | 2.5% |

| 6 | Utilities & Services | 2.5% |

| 7 | Domestic Appliances | 2.3% |

| 8 | Property | 2.3% |

| 9 | Alcohol | 1.7% |

| 10 | Health & Beauty | 0.6% |

| 11 | Sports | 0.4% |

| 12 | Chilled/Frozen Foods | -1.1% |

| 13 | Consumer Electricals | -1.3% |

| 14 | Life Insurance, Pensions & Wealth Management | -1.4% |

| 15 | Car Sales, Service & Fuel | -1.7% |

| 16 | Hotels & Cruises | -1.8% |

| 17 | TV & Radio | -1.9% |

| 18 | High Street Fashion | -2.3% |

| 19 | Leisure & Entertainment | -3.2% |

| 20 | Snack Food | -3.3% |

| 21 | Credit Cards & Payment Services | -3.5% |

| 22 | High Street Fashion | -4.2% |

| 23 | Airlines | -4.5% |

| 24 | Cosmetics & Skincare | -4.7% |

| 25 | Pubs & Fast Food | -6.5% |

| 26 | Transport | -7.4% |

| 27 | Banks and Building Societies | -8.1% |

Rishi’s stamp duty holiday sees Property industry growth of over 2%

The UK was one of the worst hit among major economies in Europe in the wake of the coronavirus. While some industries have been left decimated by this, UK Supermarkets sales increased the most by 6.01% since March. Online retailers who opted for mega-sales paid off with the industry seeing just shy of a 5% overall growth. And thanks to Rishi’s stamp duty holiday, Property grew by 2.31% in just eight months.

Brits swapped cosmetics for care

Unsurprisingly, the restrictions on movement across the country have caused travel, car and fuel sales to decrease by 1.7%.

Cosmetics and skincare products have also plummeted by 4.68% as Brits opt for a more au natural look for zoom calls. However, Healthy & Beauty has seen a 0.6% uptake suggesting that In a time where social events are restricted to webcams, Brits have become less interested in covering up imperfections, and more interested in maintenance and self-improvement.

Jon Knott, Head of Customer Insights at Dojo said:

“Last year saw changing fortunes in the economy, which have forced retailers to face some of the toughest challenges in generations. Circumstances beyond control have led to rapid consumer shifts, that were previously unheard of.

A lot of retailers have pivoted in order to survive, with some understandably being unable to do so.

But we’ve also seen other businesses thrive during this time. Our findings confirm that whilst it may have been a tough year for everyone, many industries will come out of the otherside, with some maybe even stronger than ever in 2021.”