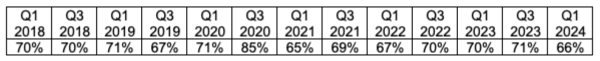

The percentage of UK small businesses considering new projects to achieve business growth (66%) has fallen to its lowest level since January 2021, according to new research by Novuna Business Finance.

Further, the Novuna study suggests the businesses that need to improve their fortunes most urgently are the very enterprises stepping back from investing in new growth initiatives. Compared to last quarter, 57% of businesses facing contraction said they were looking at projects to create future growth (falling from 68% last quarter) – and among those predicted a flat period of zero growth, the figure also fell sharply from 63% to 54%.

The latest findings are from Novuna’s Business Barometer study, which has been tracking the growth outlook of UK small businesses every quarter for the last 10 years. The new study asked a nationally representative sample of 1,224 small business owners if they were considering new initiatives to power future business growth – and, if so, what they were planning to do.

Percentage of small businesses considering new initiatives to achieve growth:

The concerning decline in the percentage of businesses investing in new growth initiatives comes at a time of heightened concern over market volatility – and a period of stagnation, with no change in small business growth outlook for the last five consecutive quarters.

Percentage of small business owners predicting growth each quarter:

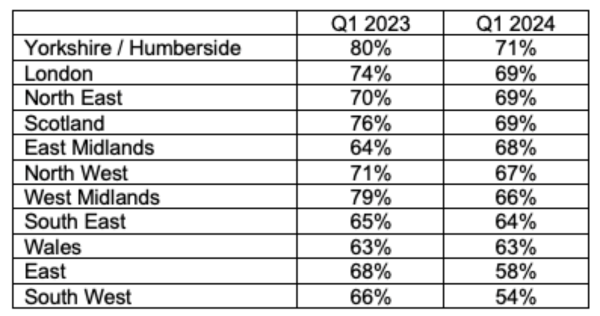

The picture around the UK also paints a picture of contraction, with the East Midlands being the only UK region where there was a year-on-year rise in the percentage of small businesses considering new growth initiatives. In nine of 11 regions surveyed, fewer business owners were backing new growth initiatives – with some of the most significant falls in the West Midlands, East, Scotland and Yorkshire/Humberside.

Percentage of small businesses considering new initiatives to achieve growth by region: 12-month comparison:

Of those that were forging ahead with new initiatives, there was no significant change over 12-months in terms of what small businesses were planning to do. The most common new initiatives to support future growth comprised of:

- Better managing cashflow – 32% (31% in Q1 2023)

- Reducing fixed costs – 56% (57% in Q1 2023)

- Dealing with late payment – 25% (24% in Q1 2023)

- Investing new equipment – 20% (16% in Q1 2023)

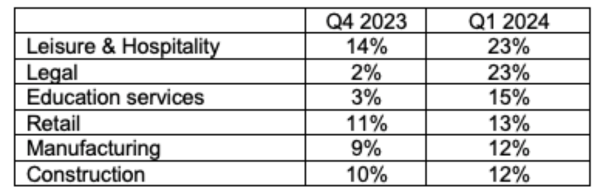

There was one notable positive change. Across six industry sectors, the Novuna data revealed a quarter-on-quarter increase in the percentage of small business owners that had resolved to re-assess their financial commitments as a stepping stone to help secure further growth

Of enterprises predicting growth, sectors where more small businesses prioritised the need to re-asses finance commitments

Jo Morris, Head of Insight at Novuna Business Finance commented:

“Over the last few years, small businesses have been thrown almost every challenge imaginable. Brexit uncertainty, the Scottish referendum, a global pandemic and a cost-of-living crisis. Whilst there are currently hopes the UK may soon exit from recession, our latest research presents a note of caution. The percentage of small businesses predicting growth has remained flat for the last five consecutive quarters. And from this new data, we also now see signs of a decline in the proportion of enterprises working on new initiatives to secure growth for the months ahead.

“One positive we do note from the data is the focus on cost control in uncertain times remains a top priority – and as part of this operational prudence, more business leaders are now looking at their funding arrangements and financial commitments. At Novuna Business Finance, we work with our partners and intermediaries to provide flexible tailored financial solutions that help small businesses to achieve their true potential.”