ESG is set to move up the agenda in the capital markets direct lending sector with the growth of a loan market delivering for socially sustainable projects seen as the biggest priority according to new research.

Ocorian’s research with capital markets executives working in direct lending in the US and UK specialising in first lien loans to companies with under $1 billion annual revenue shows 82% expect the focus on integrating ESG principles into the loan terms will increase over the next 18 months.

Nearly one in five (17%) believe the focus on ESG integration will increase dramatically, the study by the leading provider of private client, fund, corporate, capital markets, and regulatory and compliance services shows.

The biggest ESG priority for people working in the US direct lending market identified by the research is the facilitation of a loan market to support socially sustainable economic growth and activity such as building affordable housing.

More than three-quarters (76%) of those questioned state that as their biggest priority; ahead of 59% who said it was using service providers who can demonstrate a commitment to ESG. Around half (51%) said their priority was gaining access to more diverse pools of investors and particularly those looking for projects with a positive ESG focus.

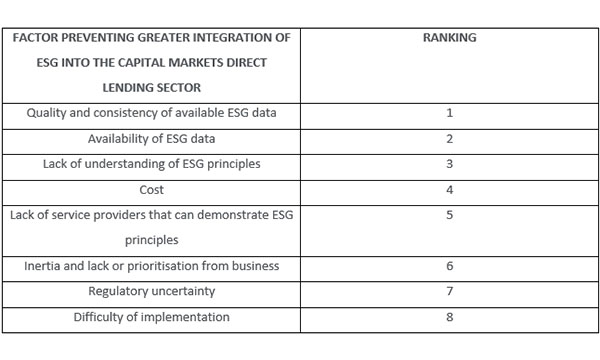

However, the quality of data is the biggest problem preventing greater integration of ESG principles into the capital markets direct lending sector as the table below shows.

Martin Reed, Head of Capital Markets – Americas at Ocorian said:

“ESG is firmly established as a core part of business operations in the direct lending sector and that can only increase as our research shows. It is interesting to see that socially sustainable lending is seen as the key priority by market participants but worrying to see that data quality and availability is a major issue.”