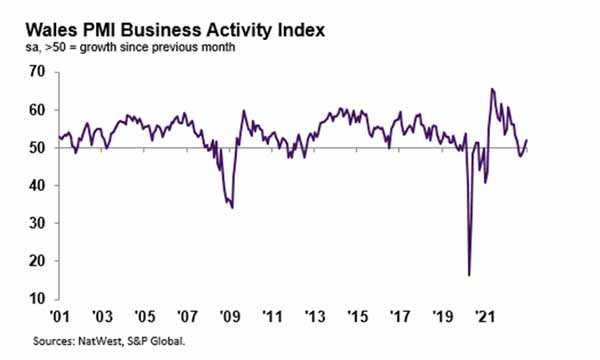

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 52.0 in December, up from 49.8 in November.

The latest data signalled a modest uptick in business activity across the Welsh private sector at the end of the year. The rise in output was the fastest since June, with companies linking the expansion to greater client demand and a renewed increase in new business. Welsh firms were the best performing of the 12 monitored UK areas and bucked the wider UK trend, which indicated a marginal contraction in output.

Welsh private sector firms recorded a return to growth in new business at the end of 2022, thereby ending a four-month sequence of contraction. Welsh businesses bucked the UK trend, with the average across the UK as a whole signalling a modest decline in new orders. Firms often stated that increased new business was due to stronger client demand. The rise in new orders was only marginal, however.

Output expectations for the year ahead at Welsh private sector firms strengthened for the second month running in December. Confidence reportedly stemmed from hopes of a pick up in client demand and investment in new products. The level of optimism was lower than the series and UK averages, however. Firms noted that efforts to keep costs down amid inflation concerns harmed expectations.

December data signalled broadly unchanged levels of employment across the Welsh private sector, as the respective seasonally adjusted index posted fractionally above the 50.0 no change mark. A fall in manufacturing staffing numbers was offset by job creation in the service sector. The UK average indicated a marginal contraction in workforce numbers.

Welsh private sector firms registered a slower fall in the level of outstanding business at the end of the year. The rate of decline was only marginal and the softest since May. The decrease in backlogs of work was largely linked to greater stability in supply chains which allowed firms to process incoming new business. That said, increased new order inflows led to the slower contraction.

The fall in incomplete business was slower than the UK average.

December data signalled another historically elevated rate of cost inflation at Welsh private sector firms. Increased cost burdens were linked to higher energy and material prices. Nonetheless, the pace of inflation eased for the third month running to the slowest since April 2021. Service sector firms recorded sharper price rises than their manufacturing counterparts.

Welsh private sector firms indicated a slightly slower uptick in costs compared to the UK average.

Welsh private sector firms signalled a marked rise in output charges at the end of 2022. Higher selling prices were often due to the pass-through of greater costs to clients, according to panellists. Although sharper than the long-run series average, the rate of charge inflation was the slowest since August 2021.That said, Welsh companies recorded the second-fastest rise in output prices of the 12 monitored UK areas, slower than the West Midlands only.

Kevin Morgan, NatWest Wales Regional Board, commented:

“Welsh firms ended the year on a promising note, as business activity and new orders returned to expansion territory in December. Modest upturns followed stronger demand conditions, with Wales the strongest performing monitored area of the UK. Nonetheless, cost pressures continued to impact business decisions, as employment was broadly unchanged amid cost cutting initiatives and reductions in temporary labour.

“Cost burdens and output charges continued to rise at historically elevated rates, as energy price hikes were passed through to customers. Inflationary pressures eased, however, amid reports of reductions in some key input prices.”