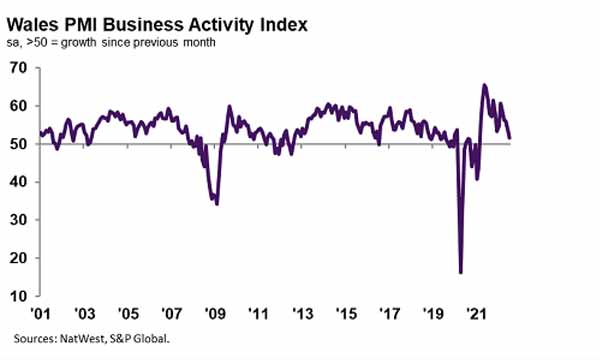

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 51.6 in July, down from 53.6 in June, to signal only a marginal upturn in output across the Welsh private sector.

The rise in business activity was the slowest in the current 17-month sequence of growth and slightly softer than the UK average. Greater output was linked to a further uptick in client demand and new order inflows.

Welsh private sector firms registered a further expansion in new business during July, with the rate of growth quickening slightly from June's 16-month low. Welsh firms were among only three UK areas to report an upturn in new orders, alongside the South East and London. Anecdotal evidence stated that the increase in new business stemmed from a modest uptick in client demand.

The rise in new orders was broad based, with manufacturers and service providers recording an increase.

July data signalled a further uptick in business confidence at Welsh private sector firms. Output expectations for the coming 12 months were the strongest for three months and higher than the series trend. Companies attributed greater optimism to hopes of price and supply chain stability, alongside increased client demand.

Welsh firms were also more optimistic regarding the outlook for output than the UK average.

Welsh private sector firms recorded a strong upturn in employment at the start of the third quarter. The rate of job creation was broadly in line with that seen in June, but slower than the UK average. Companies attributed higher workforce numbers to an uptick in client demand and greater new order inflows.

Manufacturers and service providers registered an increase in employment, with the latter recording a sharper rise.

The level of outstanding business at Welsh private sector firms fell for the third month running in July. The decrease in work-in-hand quickened to the fastest since February 2021 and contrasted with the UK average which pointed to broadly unchanged levels of incomplete business. Relatively soft demand conditions and sufficient capacity reportedly allowed firms to work through their backlogs.

Welsh private sector firms indicated a softer pace of cost inflation during July. Although the pace of increase remained historically elevated and quicker than in any period before October 2021, it was the slowest since then. Higher input prices were linked to greater energy, fuel, material and wage costs.

The rate of inflation was also substantial in relation to other UK areas, slower than only Northern Ireland and the South East.

Average output charges increased markedly at the start of the third quarter, albeit at a softer pace. The rise in selling prices was attributed to the pass-through of higher costs to clients. That said, in line with the trend for slower increases in cost burdens, firms recorded the softest rise in output charges since September 2021.

The rate of charge inflation was, however, among the fastest of the UK areas, slower than only Northern Ireland, the North East and the South East.

Gemma Casey, NatWest Ecosystem Manager for Wales, commented:

“Welsh firms continued to register output growth during July, as the upturn in new business regained pace. That said, the respective expansions were subdued in the context of those seen over the past year as price pressures softened demand conditions.

“Despite signs of spare capacity and a decrease in backlogs of work, companies increased workforce numbers strongly and recorded a greater degree of confidence in the year ahead outlook for output. Amid hopes of greater price stability, firms reported the slowest rise in input costs since September 2021. The rates of increase remained historically marked, however, and faster than any seen before October 2021 as inflationary headwinds endure.”