The Celtic Freeport has the potential to drive long-term economic growth across South West Wales by attracting new investment and supporting supply chain development, according to business leaders involved in shaping and delivering freeports across the UK.

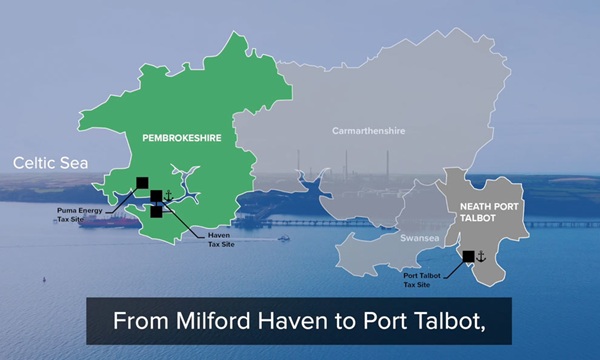

Spanning the ports of Port Talbot and Milford Haven, the Celtic Freeport is expected to play a central role in the UK’s energy transition. Its backers argue that the combined strengths of both ports — with Milford Haven as a major energy hub and Port Talbot as a centre for energy-intensive industry — give it a strategic advantage.

Speaking on the Celtic Freeport: Unlocking Opportunity podcast series, Luciana Ciubotariu, CEO of the Celtic Freeport, said the model offers more than just tax incentives.

“The Freeport is not just a tax-free zone,” she said.

“It’s a catalyst for productive investment and a way of creating long-term economic value for the region.”

As well as business rates relief, capital allowances and employer national insurance incentives, the freeport model allows local authorities to retain business rates generated on freeport sites for up to 25 years. These can then be reinvested in infrastructure, skills and local supply chains.

Lewis Atter, managing director at KPMG, said these retained rates could prove just as important as the initial tax breaks.

“If you look at the overall financial scale, the value of the tax breaks and the value of the retained rates are broadly equal,” he said.

“In the longer term, those retained rates may have the biggest impact in terms of investment and employment.”

Lewis also stressed the need for businesses to act within clear timeframes, with incentives tied to investment being made before 2034. He added that businesses considering locating in a freeport must demonstrate that their activity is new and additional to what already exists, rather than simply relocating to access benefits.

This focus on additionality is shared across UK freeports, including in Liverpool, where Giles Jones, Freeport Manager for the Liverpool City Region, said measures are in place to guard against displacement.

“We’ve implemented a gateway policy to ensure that support is only given to businesses making a genuinely new investment,” he said.

Liverpool’s freeport has already secured £250 million in investment and is starting to see the first signs of job creation. Giles noted that the customs benefits in particular — including duty suspension, duty inversion and duty exemption — have been well received by manufacturers and logistics firms. In Liverpool, seven companies have already become designated customs site operators, with further interest continuing to grow.

He added that international businesses often understand the freeport model from experience in other countries, helping to accelerate conversations around investment.

In Wales, Luciana said there is already significant interest from businesses active in sectors such as floating offshore wind, green steel and hydrogen. Some are exploring whether the Celtic Freeport is the right fit, taking into account land, infrastructure and planning timelines.

“It’s not about one-size-fits-all,” she said.

“We want to make sure that what we offer is the right proposition for that particular business.”

She also highlighted the importance of the Celtic Freeport’s design, which was jointly developed by the UK and Welsh Governments. The model incorporates the Well-being of Future Generations Act and principles of Fair Work, and is aligned with the UK and Welsh Government’s’ economic ambitions.

The partnership between the two ports and the surrounding local authorities was key to the original bid and remains central to the freeport’s approach. Luciana said the collaboration between Milford Haven and Port Talbot is a strength, with each location playing a different role in supporting Wales’ transition to a cleaner and more resilient economy.

Looking to the future, Lewis said freeports should be seen as part of a wider national strategy.

“The freeport acts as a multiplier,” he said.

“It helps at the margins in terms of investment viability and then provides a revenue stream to support long-term economic renewal.”

Luciana echoed that view.

“What I’d like to see in 20 years is a transformed Welsh economy — one that’s more diversified, more resilient, and where people choose to stay and build their lives here.”