According to the latest NatWest Wales PMI data, private sector firms registered a marked fall in business activity at the end of the first quarter.

The outbreak of coronavirus 2019 (COVID-19) and the enforcement of emergency public health measures weighed on client demand and led to the fastest contraction in new business since February 2009. Subsequently, firms cut workforce numbers at a strong pace, although companies were still able to process backlogs of work at the quickest rate for 11 years. Uncertainty towards how long the virus outbreak will last dragged business confidence down to the lowest level since January 2019.

Meanwhile, inflationary pressures softened, with the rate of increase in input costs easing to the slowest since June 2016.

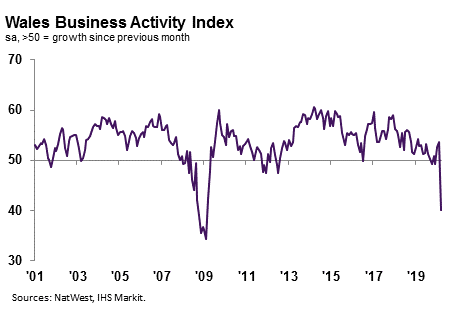

The headline Wales Business Activity Index – a seasonally adjusted index that measures the combined output of the manufacturing and service sectors – registered 40.0 at the end of the first quarter, down from 53.7 in February, and signalling the strongest contraction in business activity for over 11 years and a stark turnaround from the solid expansion seen midway through the quarter. The pace of decline was slower than the UK average, however.

New business declined at a marked pace in March, as the spread of COVID-19 resulted in reduced client demand and customer cancellations. The rate of decrease was the sharpest since February 2009, as service providers recorded a substantial drop in new orders. Although the quickest since the financial crisis, the pace of contraction was the second-slowest of the 12 monitored UK areas (faster than only the North East).

In line with lower new business volumes, firms cut workforce numbers at a strong rate in March. The decrease was the quickest for five months, but slower than the UK average.

Despite a drop in employment, the decline in client demand allowed firms to process backlogs of work at the fastest pace for 11 years.

Average cost burdens continued to increase in March, as shortages of raw materials drove input prices higher. Although the pace of inflation was the slowest since June 2016, it was among the fastest of the 12 monitored UK areas.

Output charges were unchanged, however, as firms tried to retain clients and stay competitive.

Business confidence slumped to the lowest since early-2019 in March, as the outbreak of COVID-19, the resulting drop in demand and fears over the longevity of lockdowns, weighed on output expectations for the year ahead.

Kevin Morgan, NatWest Wales Regional Board, commented:

“The impact of the COVID-19 outbreak was felt keenly by Welsh private sector firms, as output and new business were reduced at the fastest rates since February 2009, during the depths of the financial crisis. Firms reported a sharp drop in client demand as some customers cancelled previously made orders, although the fall was slower than the UK average.

“To remain competitive, firms left selling prices unchanged from February in an effort to retain customers, despite a further rise in input costs.

“Meanwhile, lower demand resulted in a strong decrease in employment and a drop in business confidence. Company worries about the longevity of the COVID-19 outbreak and the damage done to the global economy weighed optimism down to the lowest since January 2019.

“We’re supporting businesses across Wales through these difficult times and we know they need our help more than ever. Our support includes capital repayment holidays, Coronavirus Business Interruption Loan Scheme (CBILS), overdrafts (with no fees up to £5k) and immediate access to deposit balances with no penalty.”