The UK housing market is grappling with its most significant annual price decline since 2009 with a -0.3% drop in house prices in September, marking the fourth-largest monthly fall of 2023.

The decline is due to rising mortgage costs and increasing living expenses, impacting disposable incomes.

However, prices are still above pre-2021 levels, with regions like Yorkshire and Humber and the East Midlands maintaining growth. Meanwhile, the South West saw a sharp 2.4% annual price decline.

While some buyers may return due to a pause in interest rate hikes and increased mortgage market competition, many are waiting for lower rates and the right property, suggesting pent-up demand that could emerge if market conditions improve.

Richard Sexton, Director at e.surv, comments:

“Although September saw a less severe drop in house prices compared to August, house prices in England and Wales fell at their fastest pace over the last 12 months since 2009.

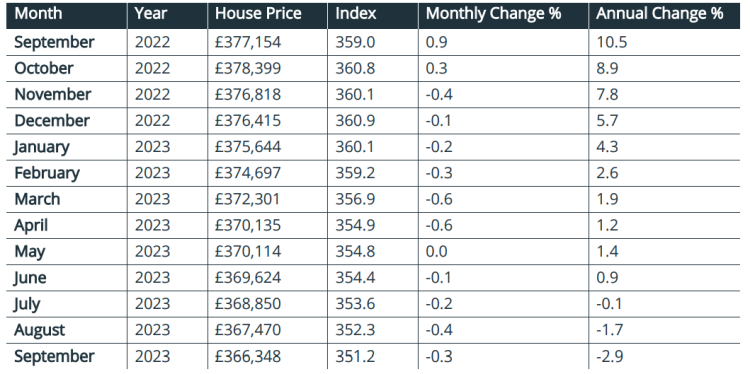

“Our data, which includes cash purchases, shows that house prices have fallen by some -£1,122, or -0.3%, in September, the fourth largest monthly fall of 2023. Prices have now dropped every month since November 2022. However, we should see this in the context that prices are still above the level they initially were when the Bank of England started tightening interest rates in December 2021.

“Regionally, Yorkshire and Humber and the East Midlands continue to perform relatively well with house prices maintaining steady growth and outpacing other regions of the UK. The South West saw the biggest fall in annual house prices, of 2.4% more than July of this year.

“The fall in UK house prices is largely down to the higher cost of mortgage finance plus the squeeze on disposable incomes from the higher cost of living. Across the UK’s biggest lenders, the average mortgage rate for a 5-year fix with a 75% loan-to-value ratio (LTV) currently sits at 5.1%, the lowest since July 2023, according to the Bank of England.

“The pause in base rate hikes and increasing competition in the mortgage market may see a return of some buyers who delayed their home moving decisions earlier in the year now returning to the market. However, many other buyers are still waiting for mortgage rates to come down further and for the right property to become available. This suggests that there is a pent-up demand for housing that could be released in the coming months if market conditions continue to improve.”

Table 1. Average House Prices in England and Wales for the period September 2022 – September 2023

Commentary: John Tindale and Peter Williams, Acadata Senior Analysts

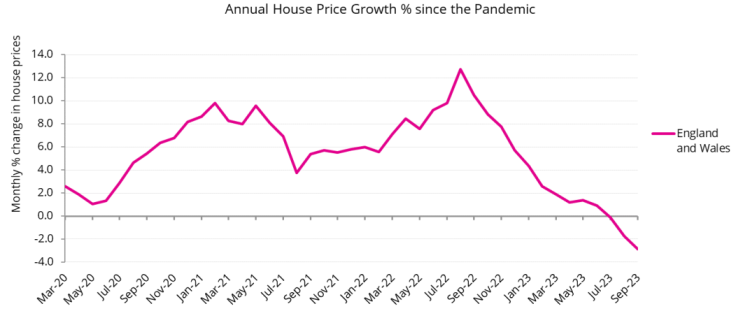

Figure 1. The annual house price growth in England and Wales, March 2020 – September 2023

On an annual basis, the average sale price of completed home transactions using cash or mortgages in England and Wales in September 2023 fell by some £10,800, or -2.9%, and now stands at £366,348. This is the lowest annual rate since September 2009, when the housing market was recovering from the aftermath of the banking crisis of 2007/2010. The negative rate of change follows almost thirteen months of consecutive drops in its value, from its peak rate of +12.7% in August 2022. The market was at that time experiencing buoyant demand following the Covid pandemic, and supported by low interest rates.

House prices have fallen by some -£1,100, or -0.3%, in the month of September, the fourth largest monthly fall of 2023. Prices have now dropped to levels last seen in June 2022.

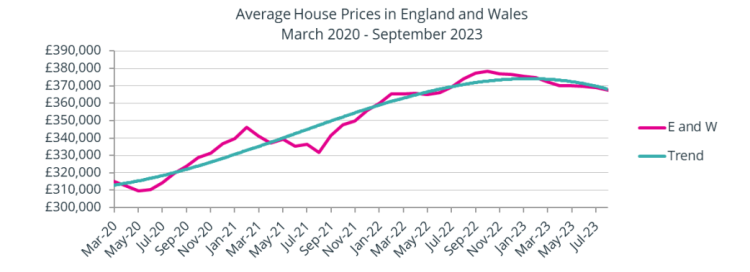

Figure 2. The average house price growth in England and Wales, March 2020 – September 2023

However – as Figure 2 illustrates – in terms of actual (nominal) prices, the fall in price of a not insubstantial £12,100 since its peak in October 2022 must be viewed against the cumulative £51,100, or 16%, rise in prices since the start of the pandemic in March 2020 – so some perspective is required. At the same time, over this same period, the CPIH Inflation Index has risen by some 19% – so in real terms, i.e., taking account of inflation, the average price of a home has fallen by -3% since March 2020. Again significant, but it is doubtful if any other asset classes have achieved a return equal to or greater than this over the same time period.

The housing market in September 2023

The housing market in England and Wales is evidently cooling, and there is every reason to expect that this trend will continue into the foreseeable future, given both the wider macro-economic context and the Bank of England’s expected interest rate policy of remaining higher for longer. This has put extreme pressures on affordability – with the resultant drop in transactions – as we show later with the shift to buying smaller homes. With fewer mortgaged transactions, cash buyers have not only become more significant in the market, but they also become more powerful in any bargaining over price. This too adds a further dimension to the price dynamics being seen.

The relatively small falls we are reporting highlight the underlying strength of the housing market, and not least the long-term imbalance in supply and demand. Expectations as to how much the market might unwind vary, but no one is suggesting a market collapse. Indeed, given the evident importance of housing issues in the current pre-election policy jostling, it is clear there may well be attempts to restimulate the market in the Chancellor’s Autumn Statement on 22nd November. This could take the form of tax assistance, as well as a new affordable home ownership policy. It is clear a number of options are being considered. Given that, it becomes more difficult to suggest when the market might stabilise and recover. As prices ease, and when interest rates begin to fall, so more households will return to buying and selling – and as momentum gathers so we can expect to see prices strengthen.

Average Annual English Regions and Wales House Prices

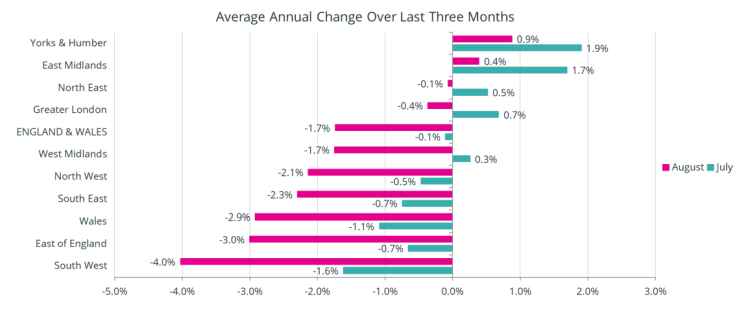

Figure 3. The annual change in the average house price for the three months from July to September 2023, analysed by GOR

Figure 3 shows the percentage change in annual house prices on a regional basis in England and for Wales, averaged over the three-month period of July to September 2023, compared to the same three months in 2022. These figures are calculated on a rolling three-month basis to smooth out the minor changes in price which almost inevitably arise, and are centred on August 2023 (pink line), with Figure 2 also showing the similarly averaged figures for July 2023, one month earlier (blue line). The Acadata prices are also adjusted for seasonal variation.

It can be seen that in August there are eight GOR areas with a negative movement in their rates of change, compared with just five in July. This month, it is the South West that continues to report the largest fall in its rates at -4.0%, compared to its rate of -1.6% in July.

In the South West, all 14 of its 14 constituent areas saw their prices fall over the previous twelve months. The three constituent areas in the South West with the largest price falls over the year were Wiltshire, -9.4%, Bournemouth, Christchurch and Poole, -8.0% and Gloucestershire, -4.8%.

The two GOR areas with a positive change in their annual growth rates over the previous twelve months were Yorkshire and the Humber at a modest +0.9%, and the East Midlands at +0.4%. The East Midlands has been in one of the top five places in the above League Table for each of the last fifteen months, while for Yorkshire and the Humber it has been in one of the top five places for the last seven months.

In Yorkshire and the Humber it is the City of York that takes top place, with annual growth of +4.4%, while in the East Midlands the top place is Rutland with annual growth of +19.8%. This is the highest annual rate seen in August of the 110 unitary authorities and metropolitan counties in England and Wales that we monitor, although Rutland tends to have volatile price movements due to the low number of transactions in what is a relatively small area.

In Greater London, which stands in fourth place in August in the above League Table – having been in bottom position for eleven of the previous fifteen months – prices have fallen by an average -0.4% over the previous twelve months, compared to +0.7% one month earlier. In fact, in August, only 5 of the 33 London boroughs have seen prices rise over the previous twelve months, but the five include the City of London, at +21.9%, the City of Westminster, at +18.4% and Richmond-upon-Thames, at a more modest +3.2%, with these three boroughs being in the top five London boroughs when ranked by their average property values. The remaining two boroughs of the five seeing prices rise over the year were Havering, ranked 28th by its property value, at 2.6%, and Lewisham, ranked 24th by its property value, at +0.3%. On a monthly – as opposed to annual – basis, the two boroughs with the highest rise in prices in August were also the two most expensive boroughs in London, being the City of Westminster, at +3.2%, and Kensington and Chelsea, at +1.4%.

On a monthly basis, looking at the movement in the 10 GOR areas in August, there were only two areas with price increases and eight areas with price falls in the month. The two regions with price rises in the month were Yorkshire and the Humber, +0.6% and the North East, +0.2%. The three largest falls in prices in the month were in the East of England, – 1.3%, the South West -0.7% and the West Midlands -0.6%. The various changes in price growth across England and Wales thus reflect the diverse nature of the property markets across both countries.

England and Wales Regional Heat Map

These different trends are then evident in the Regional Heat Map shown below for August 2023.

There are three different clusters of regions / countries in evidence in the August 2023 Heat Map. Firstly are the two reds down the east coast of England – Yorkshire and the Humber and the East Midlands, where prices are still climbing by 0.4% or higher.

Then come the light blue regions of the North East and Greater London – rarely grouped together considering their average house prices are at either end of the property price spectrum – where prices are falling on an annual basis but by -0.4% or less.

Finally, the remaining English regions and Wales are all shaded in green with prices falling by -1.7% or more.

It will be interesting to see whether the whole Heat Map turns green next month, or whether the still buoyant regions of Yorkshire and the Humber and the East Midlands can continue to outpace the remainder of the England and Wales housing market.

Annual Change in prices

The annual price change in England and Wales in September 2023, for both mortgage and cash-based house purchases, was an arithmetic average of -2.9%. The rate of -2.9% in September is -1.2% below the revised rate of -1.7% for August 2023, and – with the exception of May 2023 – represents the thirteenth month in succession in which the annual rate of house price growth has slowed from the peak of +12.7% in August 2022. The average house price now stands at £366,348, which is close to the price seen in June 2022, some fifteen months earlier.

In August 2023, only 26 of the 110 Unitary Authority areas in England and Wales were recording house price gains over the previous twelve months. This contrasts starkly with the 54 authorities in July 2023 that had price rises over the previous year.

The area with the highest annual increase in prices in August 2023 is Rutland, at 19.8% growth – the average price being boosted this month by the sale of a five-bedroom barn conversion, located close to Rutland Water and the A1, for £1.26 million, in what is otherwise a quiet market.

By way of contrast, the Unitary Authority area with the largest fall in prices over the last twelve months is, for the second month running, Denbighshire in Wales, at -18.8%. All property types in Denbighshire have seen price falls over the year, with the largest fall being in detached homes, where prices have fallen from an average £310k in August 2022 to an average £250k twelve months later. In Denbighshire the Council Tax premium on second homes will be rising to 150% from April 2025.

Monthly Change in prices

Average house prices fell by some £1,125, or -0.3%, in September 2023, compared to £1,380, or -0.4% in August 2023. This was the eleventh month in succession in which the average price paid for a home has fallen, making the total reduction in 2023 some -£10,000. However, as touched on earlier, this total needs to be contrasted with the near £51,000 increase in prices that has taken place since the start of the pandemic – most homeowners are therefore still likely to have gained considerable equity in their property over this period, despite the recent price falls.

In August 2023, prices rose on a monthly basis in 43 of the 110 Unitary Authority areas, which is just 1 fewer than in July, perhaps suggesting a slowing rate of decline in prices over the summer months. The area with the biggest increase in prices in August was Conwy, in Wales, up by 5.0% in the month. In Conwy all property types except for flats saw prices rise in the month, with the largest rise being in detached properties, just ahead of the rise in semi-detached homes, with the price of detached homes up from an average £348k in July 2023 to an average £355k in August. The increase in Conwy’s average price in the month was assisted by the sale of a 4-bedroom detached home, built in 2016, overlooking Llandudno Bay. The premium council tax charge on second homes in Conwy is currently 50%, but the local authority has voted to increase this to 100% in April 2024.

At the other end of the scale, the authority with the largest fall in prices in August was Darlington, where prices fell by -4.8%. This fall has largely occurred as the most expensive flat of the year – a property in St Clare’s Court, Darlington, part of a former Abbey, which sold for £420k in June 2023 – dropped out of the statistics this month, resulting in a fall in Darlington’s average price.

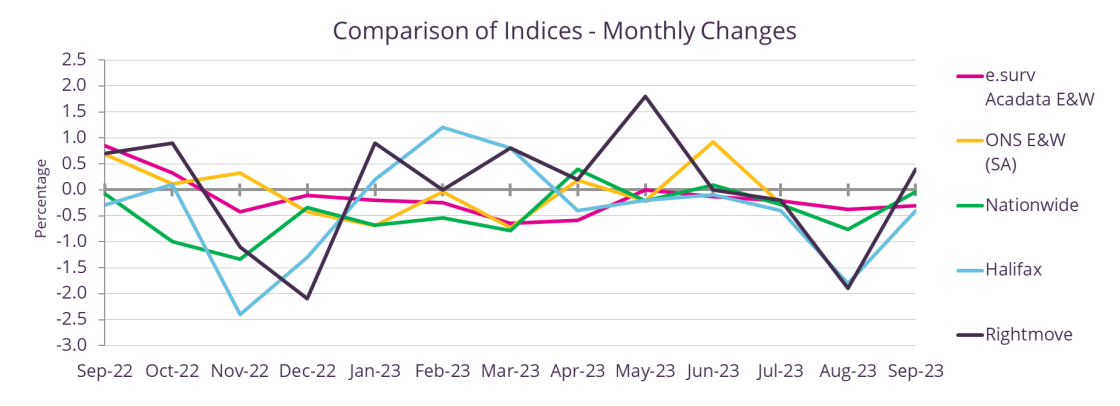

Comparison of Indices

Figure 4. The monthly change in house prices September 2022 – September 2023

This month, Figure 4 compares the monthly rate of change in house prices as measured by the five different index providers (as listed to the right of the graph), for the period September 2022 to September 2023. The monthly rates of change are more volatile than the annual rates, resulting in a less uniform pattern on display between the indices.

In September 2023 both the Halifax and Nationwide are reporting an upward movement in the monthly rate, when compared to August, with Halifax up by +1.4%, to -0.4%, while Nationwide is up by +0.8% to a no change position of 0.0% growth.

In the meantime, the e.surv Acadata Index – which includes both mortgage and importantly cash sales – is up by 0.1% from its August figure, to a rate of -0.3% in September.

Unusually, in July 2023 there was near unanimity between the indices, when the monthly rate of change was reported as being between -0.2% (Rightmove and e.surv Acadata) and -0.4% (Halifax), a range of just 0.2% – the smallest range of the last five years.

In August 2023, this range increased to 1.5%, with e.surv Acadata at -0.4% and Rightmove at -1.9%, but decreased to 0.8% in September 2023, with Rightmove at +0.4%, while Halifax reported -0.4%.

It is not unusual for Rightmove to report a substantial dip in prices in August – for example in 2022 Rightmove reported a monthly rate of +0.4% in July 2022, followed by a dip to -1.3% in August 2022 and back to +0.7% in September 2022. Rightmove ascribe this August dip to a need for potential sellers to “stand-out” in the market with an attractive discount, so as to entice purchasers to buy, in what otherwise can be a quiet market with many families being absent during the school holiday period.

In August 2023, both Halifax and Nationwide also reported a more minor dip in prices in the month, with Halifax at -1.8%, whilst Nationwide reported a more modest fall of -0.8%. Nationwide’s movement in average prices is often more conservative than the Halifax index. Over the last 12 months, the standard deviation of Nationwide’s monthly index amounts to 0.48, whilst Halifax’s standard deviation is 0.98.

Housing transactions per month

Figure 5. The total number of housing transactions per month, January 2019 – August 2023

Figure 5 shows the total number of domestic property transactions per month recorded at the Land Registry for England and Wales, covering the period from January 2019 to August 2023.

There are four years of particular interest in Figure 5. The first is the dark pink line of 2020. This year began with an average 58,640 transactions in the first three months, up to the start of the pandemic, which was announced during the latter part of March 2020, when households were instructed to remain at home (if not employed in an essential service). The announcement came too late to affect March sales, but in April 2020, the number of property transactions slumped to 24,560. Although property sales slowly increased during the remainder of 2020, the recovery was prolonged.

During 2021, the light blue line, the housing market was transformed, in part due to the tax-holidays that were made available in both England and Wales, and in part owing to the change in attitude brought about by working from home, coupled with the desire for more space. Three spikes are clearly visible in March, June and September 2021, which were all tax-holiday related. The number of transactions in England and Wales in 2021 averaged some 84,800 sales per month.

By contrast 2022, the grey line, proved to be a far more subdued and stable year than 2021, with transactions returning to an average 66,850 sales per month – some 13% ahead of the levels seen in 2020. The reduction in sales from September 2022 onward is visible, coinciding with both the arrival of Mrs Truss as Prime Minister on 6th September 2022, along with the sixth increase in the official bank rate to 2.25% on 22nd September 2022. Liz Truss departed as Prime Minister on 25th October 2022. The bank rate was further increased on 3rd November and 15th December 2022, ending the year at 3.5%. Housing sales in December 2022 totalled 60,050 – the lowest December total on the graph.

The fourth and final year of interest is 2023, the black line. The year has only seen an average of 39,300 sales per month to the end of August – the lowest level of transactions over these eight months of the last seventeen years. However, the data for each of the months in 2023 is still emerging from the Land Registry, and especially for August 2023, so these totals will slowly increase over time – although they are very unlikely to return to earlier peaks.

Housing transactions by property type

Figure 6. Housing transactions per month, by Property type, January 2022 – June 2023

Figure 6 shows the number of transactions per month over the recent eighteen-month period from January 2022 to June 2023. The data for these months are still emerging from the Land Registry over time, so the figures presented will be subject to minor change.

In general, it can be seen that the number of transactions of each property type has behaved in a similar fashion one to the other, with perhaps some subtle changes, as described below. Also clear is that the level of transactions in 2023 is in general lower than the equivalent months in 2022, with the decline in sales taking place from September 2022 onward (August 2022 was the high point for each of the four property types, except for flats, which occurred in March 2022). An uptick in sales in March 2023 across all property types is also visible – this is a trend that tends to occur in most years as the spring housing market takes hold.

The number of sales of both semi-detached (pink line) and terraced properties (grey line) are virtually equal to each other across the whole eighteen-month period, making the two graph lines difficult to distinguish from each other in Figure 6 at the scale used.

Detached sales (black line) are below both semi-detached and terraced levels for the whole of the eighteen months. Taking the average of semi-detached and terraced properties, and looking at the difference from detached properties, the average difference over the period was 3,005 properties, with the minimum difference taking place in June 2022, at 2,221 properties, and the maximum in December 2022 at 3,717 properties. If we look at the average difference per month between the two groups, for the first six months of 2022 it amounts to 2,594 properties, compared to 3,269 in the first six months of 2023. In other words, detached property sales have become less popular in 2023 than in 2022, compared to semi-detached and terraced properties.

A similar exercise for flats, shows that the difference in sales between the average for semi-detached and terraces and flats was 6,503 properties in the first six months of 2022, which had reduced to 5,069 properties in the first six months of 2023. In other words, flats have become a more popular purchase compared to semi-detached and terraces in 2023 than in 2022. However, in terms of overall numbers, semi-detached and terraced sales have fallen by 33% between the first six months of 2022 and 2023, while detached properties have reduced by 43%, flats by 39%, and all property types by 37% over the same period.