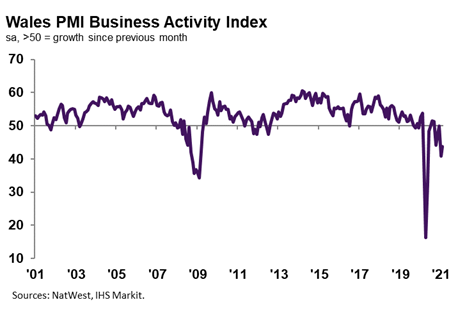

The headline NatWest Wales PMI® Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 43.7 in February, up from 40.8 in January.

The latest data indicated a further sharp decline in output across the Welsh private sector, albeit slightly slower than that seen at the start of the year. Anecdotal evidence stated that lower activity was due to weak client demand, temporary client business closures and coronavirus disease 2019 (COVID-19) lockdown measures.

New orders received by Welsh private sector firms decreased solidly midway through the first quarter. The fall in new business was often linked to the ongoing COVID-19 pandemic and temporary client business closures due to lockdown restrictions. The rate of contraction in client demand was stronger than that seen across the UK as a whole.

Welsh firms signalled more upbeat expectations regarding the outlook for output over the coming year in February. The degree of confidence was the highest for seven years amid hopes of a successful vaccine roll-out and the reopening of the hospitality and retail sectors. Many companies were also positive of a marked pick up in client demand once restrictions begin to lift.

The level of positive sentiment was below the UK average, however.

Workforce numbers decreased for the twelfth successive month in February, albeit at a slower pace. The decline in employment was attributed to reduced new order inflows and efforts to cut costs. Although quicker than the UK average, the pace of job shedding was the slowest in the aforementioned sequence of contraction.

Welsh private sector firms indicated a further fall in backlogs of work midway through the first quarter. The rate of depletion in incomplete business quickened to a solid pace that was in line with the UK average. Firms were reportedly able to work through their outstanding business following lower new order inflows.

Private sector firms operating across Wales registered another marked monthly increase in input prices during February. The rate of cost inflation outpaced that seen across the UK as a whole and was the quickest for three years. Companies stated that higher costs were due to supplier price hikes, greater transportation charges and additional transaction fees following Brexit.

Average output charges at private sector firms in Wales rose once again in February, with the pace of inflation accelerating. The rise in output prices was the quickest for a year and faster than the UK average. Firms commonly attributed higher charges to the partial pass-through of greater costs to clients.

Kevin Morgan, NatWest Wales Regional Board, commented:

“Welsh private sector firms registered a fall in output once again in February, as the COVID-19 pandemic and associated restrictions hampered new sales. Although the rate of decline in new business eased, firms were forced to make further job cuts in an effort to rein in spending.

“Price pressures remained robust, as cost burdens soared following supplier price hikes and shortages. Firms were able to partially pass-through higher costs to clients. That said, the pace of input price inflation far outpaced that of charges.

“Despite challenging business conditions and ongoing lockdown measures, firms were markedly upbeat regarding the outlook for output over the coming year. The level of optimism was the strongest for seven years.”