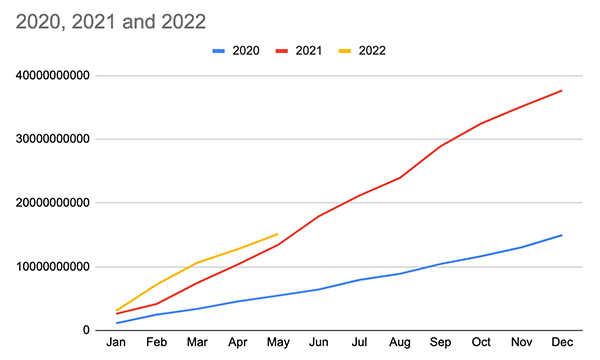

UK tech companies have raised more venture capital funding in the first five months of 2022 than in the whole of 2020.

This puts the UK second to the US globally when it comes to startup investment and means that UK startups are outperforming those in China, France and India, when it comes to attracting funding, according to data by Dealroom analysed for the UK’s Digital Economy Council. The new figures demonstrate the strength and resilience of the UK startup sector.

So far, more than 950 UK tech startups and scaleups have raised £12.4 billion in 2022, compared to £12bn for the whole of 2020. In a record-breaking first quarter, UK tech raised £9bn, up from £6.3bn the same time last year, with the UK ahead of India and China when it comes to startup funding, as well as raising more than double the funding raised by French tech companies. This influx of capital means the UK is now home to 122 unicorns, with more than 20 cities and towns home to at least one unicorn, and 248 futurecorns. More than a third of the fastest-growing next-generation tech companies in Europe are now based in the UK.

The new data coincides with the launch of London Tech Week, which brings together leading names from across the UK’s digital industries.

UK cities in the top 20 for Europe investment

London has dominated tech investment in Europe this year, raising £8.6bn, double Paris (£3.9bn) and over four times the amount of Berlin (£1.9bn). It’s not just London that is thriving in Europe – Bristol and Oxford both made it into the top 20 European tech hubs for investment raised this year, raising £220m and £248m respectively. Bristol-based ClearBank, the UK’s new clearing bank, raised £181m in March, whilst Oxford-based drug discovery company OMass Therapeutics raised £75.5 million in a Series B round in April.

Sustained investment over the past few years means that three UK regional cities and towns – Cambridge, Oxford and Abingdon – are amongst the top 20 European futurecorn hubs. Together they are home to 18 futurecorns including Healx, Oxbotica and Immunocore.

Not only are regional startups raising large sums, but regional investors are too. This year, Leeds-based Northern Gritstone has raised £215m to deploy in university spinouts across Manchester, Leeds and Sheffield and Manchester-based Praetura Ventures has raised £100m to support startups in the North of England. Cambridge Innovation Capital has also raised its largest fund to date, £225m, to invest in high-growth companies in sectors including health tech and enterprise software.

Fintech dominating tech rounds

Fintech has come out as the strongest sector for UK tech investment this year with £6.2 billion raised by fintech startups and scaleups already this year. Notable rounds included Checkout.com which raised nearly £800 million in Series D funding in January to become the UK’s most valuable private fintech and Paddle, a payments provider, which raised £162.2m to become a unicorn earlier this year.

After fintech, healthtech was the second-most popular sector for investment so far in 2020, with around £791m invested. Outside of fintech, the largest investment round this year was for CityFibre, the UK’s largest independent full-fibre infrastructure platform, which raised £300m in investment by Mubadala Capital Ventures in March to bring full-fibre networks to homes and businesses across the UK.

Impact tech companies, which are using technology to solve challenges including climate change, are continuing to grow and scale across the UK. Last year, over £2.7 bn was invested in impact startups – representing the most ever, in a single year. In 2022 so far tech businesses focusing on impact have raised over £791m. The largest investment raised by an impact startup this year was for Carbon Clean Solutions, a London-based carbon capture company which raised over £118m in a Series C round in May.

Increased flow from international investors

Increasingly international investors are backing UK tech. US investors have put more money into UK companies than they did in the whole of 2020, investing £6.1bn this year compared to £6bn in 2020, and Asian investors have taken part in 60 deals this year investing £2.3 billion. This demonstrates that despite a predicted slowdown in the wider tech ecosystem, UK tech is continuing to be seen as a strong bet by domestic and international investors.

Yoram Wijngaarde, founder and CEO at Dealroom, said:

“Despite the wider global challenges that have led to a slow down in public markets, private tech investment in the UK is continuing to grow. The UK has cemented its reputation as one of the best places to invest in fintech, with more fintech investment going into the country in the first part of this year compared to even the Bay Area. Nearly everything will be affected by the downturn we’ve entered into, but overall the UK tech sector is in a strong position than it's ever been before in terms of breadth and depth of the entire ecosystem.”

George Henry, general partner at LocalGlobe, said:

“As we head into London Tech Week, it’s great to see how UK startups and scaleups are leading tech investment across Europe. Whilst fintech investment is continuing to dominate, it's great to see that areas such as digital health and e-commerce are still of strategic importance following the Covid-19 pandemic which highlighted the need for accessible and efficient tools for everyone.”

Luisa Alemany, associate professor of management practice in strategy and entrepreneurship at London Business School’s Institute of Entrepreneurship and Private Capital, said:

“London’s tech sector has had one of its strongest periods yet with more startups launching here than ever before. We know that times of greatest uncertainty lay the groundwork for innovation and entrepreneurship and we’re seeing that reflected in the new ventures that are popping up now to tackle the energy crisis and climate change. It’s an exciting moment to be an entrepreneur and those launching in London can benefit from a supportive investor and peer community to help them thrive which has seen LBS alumni startups including fintech WorldRemit scale to unicorn status.”

Daniel Korski, DEC member and CEO of PUBLIC, said:

“The UK continues to be a leading light for exciting and dynamic impact and solution-focused startups. We’ve been working hard to enable an environment where anyone can become an entrepreneur and set up a business that can make a difference and it's great to see this momentum continuing beyond the pandemic.”

Deborah Okenla, DEC member and founder and CEO of YSYS, said:

“Record numbers of tech startups are being launched every day in the UK and it's great to see the excitement and drive of more and more people taking the plunge and becoming founders. We must continue to make sure that people from diverse backgrounds can access the funding and support they need to thrive – we need to ensure that tech is forever and not just a small subset of the population.”

Lucile Cornet, partner at Eight Roads, said:

“It’s been an exciting few years investing in UK tech with more startups and more compelling companies than ever before. The European start-up community is booming and I'm certain it will be the birthplace of the next generation of global leaders. From cybersecurity to fintech and SaaS, groundbreaking innovation is taking place every day and it’s certainly an interesting time to be investing here.”

Taavet Hinrikus, co-founder of Wise, said:

“I’ve been investing in startups across Europe for nearly 15 years and the past 12 months have been unlike any I’ve experienced. I believe we’re at the start of a new frontier for technology and I hope to find and support the next 100 iconic companies that will be started in the UK and grow into global giants.”

Dom Hallas, DEC member and executive director at Coadec, said:

‘We’ve been working hard to create a regulatory and business environment that enables groundbreaking startups to launch and scale. These numbers are testament to the hard work of the entire ecosystem, from founders to investors and community supporters. The economic situation now may be different to what it was last year but this demonstrates that we’ve laid the groundwork to help many businesses thrive and hopefully they will come out of this stronger than before.”

Russ Shaw CBE, founder of Tech London Advocates and Global Tech Advocates, said:

“As we head into London Tech Week, it’s great to see the strength and resilience of the entire UK tech ecosystem, not just London’s. Data like this is important to showcase where we are but it also helps motivate us to do better – we want to see more diverse founders and more impact companies launching to take on the difficult global situations we’re facing. And if there’s anywhere that can do that successfully, it’s UK tech.”

Harry Briggs, managing partner at OMERS Ventures, said:

“Transformative ideas come out of challenging situations – we saw this post-2008 and we’ve been seeing this during and after the Covid-19 pandemic. This new generation of startups is taking on challenges such as tackling the climate crisis to creating revolutionary digital health diagnostic tools and I’m optimistic that the next generation of tech startups will be even bigger and more transformative than the last.”

Pierre Dutaret, CEO of Libeo, said:

“The UK is one of the most forward-thinking countries when it comes to fintech uptake and investment but when it comes to SMEs, many businesses are still relying on old-school methods such as paper cheques to pay suppliers. We’re excited to be launching Libeo in the UK to be part of this active community and help simplify invoices and payments for SMEs across the country.”